- 2025-10-31T00:00:00

- Company Research

- VHM recorded Q3 2025 results with underlying property revenue (including business cooperation contracts (BCC) and bulk sale transactions recognized as financial income) of VND12.7tn (USD489mn; -23% QoQ and -65% YoY) and NPAT-MI of VND4.2tn (USD161mn; -45% QoQ and -47% YoY), mainly supported by a bulk sales recognition in the Golden City project with a pre-tax gain of VND3.5tn (USD135mn) and continued handovers at Royal Island and Ocean Park 2&3.

- For 9M 2025, VHM’s underlying property revenue was VND40.1tn (USD1.5bn; -42% YoY) while NPAT-MI was VND14.4tn (USD553mn; -27% YoY), completing 33% and 41% of our respective full-year forecasts. We foresee insignificant changes to our 2025F NPAT-MI forecast (pending a fuller review), as we expect Q4 2025F earnings to be primarily driven by recognition of unbilled bookings (mainly from bulk presales in Green Paradise).

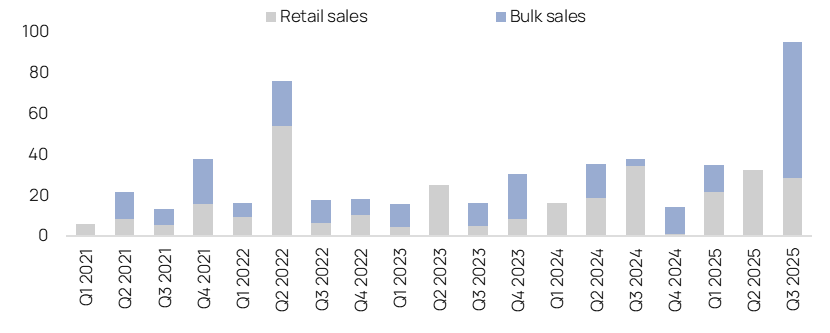

- Record Q3 2025 presales were led by Green Paradise bulk presales. VHM’s Q3 2025 contracted sales value surged 2.9x QoQ and 3x YoY to VND95.1tn (USD3.6bn), primarily driven by strong bulk presales at Green Paradise from local partners. Management expects most of the Q3 2025 bulk presales in Green Paradise to be recognized in VHM’s Q4 2025G earnings.

- Vinhomes Green Paradise (2,870 ha, Can Gio, HCMC) is one of the largest developments in southern Vietnam, with planned connectivity to the HCMC center via a proposed high-speed metro line. The project comprises four main phases (The Haven Bay, The Green Bay, The Grand Island, and The Paradise) with extensive amenities and landmarks. The project began construction in April 2025 and is currently in the market sounding stage with strong buyer interest. Management plans to commence retail presales in November 2025 with expected first launch of ~2,000-3,000 low-rise units.

- VHM’s 9M 2025 contracted sales value jumped 96% YoY to VND162.6tn (USD6.2bn), with Green Paradise contributing 40%, Wonder City 23%, and Royal Island 17%. Bulk presales accounted for 49% of total 9M 2025 presales. Given stronger-than-expected bulk presales in Green Paradise, we foresee upside potential to our 2025F contracted sales value forecast (VND131.5tn/USD5bn) for VHM, pending a fuller review.

- VHM’s end-Q3 2025 unbilled bookings amounted to VND223.9tn (USD8.6bn; +93% YoY and +62% QoQ) with bulk sales accounting for 53%.

- Management expects Q4 2025G presales to include the retail launch of Green Paradise and Lang Van and Nam Trang Cat - social housing, as well as continued presales at ongoing launched projects – such as Wonder City, Green City, and Golden City.

Figure 1: VHM’s 9M 2025 results

VND bn | 9M | 9M | YoY | 2025F | 9M as % | Vietcap’s comments on 9M 2025 results |

Net revenue | 69,910 | 51,093 | -27% | 97,415 | 52% |

|

| 48,777 | 20,808 | -57% | 75,376 | 28% | * VHM’s 9M 2025 underlying property revenue was VND40.1tn (USD1.5bn; -42% YoY) with Royal Island contributing 28%, Ocean Park 2&3 36%, and Golden City at 13%. |

| 21,133 | 30,285 | 43% | 22,039 | 137% | * Mainly construction services. |

|

|

|

|

|

|

|

Gross profit | 20,214 | 11,809 | -42% | 37,747 | 31% |

|

| 17,964 | 6,120 | -66% | 34,879 | 18% |

|

| 2,250 | 5,689 | 153% | 2,868 | 198% |

|

|

|

|

|

|

|

|

SG&A expenses | -5,400 | -4,949 | -8% | -7,820 | 63% |

|

EBIT | 14,814 | 6,860 | -54% | 29,927 | 23% |

|

Financial income | 15,536 | 21,811 | 40% | 30,063 | 73% |

|

| 10,622 | 6,034 | -43% | 17,144 | 35% | * Mainly retail handovers at the Royal Island project. |

| 4,914 | 15,777 | 221% | 12,919 | 122% | * Includes (1) a bulk sales recognition at Golden City with a pre-tax gain of VND3.5tn (USD135mn) and (2) one-off compensation income of VND5.4tn (USD208mn) in Q2 2025. |

Financial expenses | -5,477 | -10,750 | 96% | -13,039 | 82% | * The YoY increase in financial expenses was due to a higher debt balance for project financing (total debt balance at end-Q3 2025 reached VND141.5tn/USD5.4bn, up 96% YoY). |

Other gain/loss | -279 | 369 | N.M. | 0 | N.M. |

|

PBT | 24,596 | 18,293 | -26% | 46,951 | 39% |

|

PAT | 20,600 | 15,313 | -26% | 37,561 | 41% |

|

NPAT-MI | 19,642 | 14,381 | -27% | 35,205 | 41% | * The 9M 2025 NPAT-MI was mainly driven by (1) the scheduled handovers at Royal Island and Ocean Park 2&3, (2) bulk sales recognition in Golden City, and (3) other financial income in Q2 2025. * The YoY earnings decline mainly reflects timing differences in property recognition schedule. |

|

|

|

|

|

| |

Gross margin % | 28.9% | 23.1% |

| 38.7% |

|

|

| 36.8% | 29.4% |

| 46.3% |

|

|

| 10.6% | 18.8% |

| 13.0% |

|

|

SG&A as % sales | 7.7% | 9.7% |

| 8.0% |

|

|

EBIT margin % | 21.2% | 13.4% |

| 30.7% |

|

|

Effective tax rate % | 16.2% | 16.3% |

| 20.0% |

|

|

NPAT-MI margin % | 28.1% | 28.1% |

| 36.1% |

|

|

Source: VHM, Vietcap forecasts (last updated on August 29, 2025). Note: (*) Vingroup signed a business cooperation contract (BCC) with VHM to transfer the economic interest of real estate developments that are not injected into VHM due to the complexity of paperwork. Thus, VHM records all gains via financial income.

Figure 2: VHM’s quarterly contracted sales results (VND tn)

Source: VHM, Vietcap compilation

Powered by Froala Editor